In November 2008, Scott Stephens wrote his piece in response to global economic crisis. Rev. Stephens is the minister of Forest Lake Uniting Church and teacher of theology and ethics at Trinity Theological College. His article, Dishonest money: What the financial crisis tells us about ourselves is a typical example of misunderstanding the real character of capitalism.

If a capitalist billionaire himself with the caliber of Warren Buffett could misunderstand capitalism, it is but natural to see typical misunderstanding of capitalism similar to Rev. Stephens’. This is where we need discernment to see beyond the appearances of things and also the ability to distinguish between dominant social themes and alternative story.

The influence of mainstream media is very powerful to shape public opinion. Add to it the popularity of both the external and internal critics of capitalism. From the outside, we have the Marxists; and from the inside, we have people like Scott Stephens who himself enjoyed the blessings of capitalism. Both camps agreed in their analysis of the inherent flaws of capitalism.

The fear of Peter Schiff is not at all baseless. He is worried that the worsening crisis would be blamed on capitalism. This is exactly what is happening. Only few are able to take a deeper look at capitalism and realize that the so-called “inherent flaws” are really not coming from the free market, but from another version of it.

A good place to start in this social discernment is to learn the distinction between the economic positions of Warren Buffett and George Reisman. But before we do that, allow me to identify first the misunderstanding in Scott Stephens’ article. After reading Stephen’s article, you can compare it with George Reisman’s open letter to Warren Buffett and see for yourself the discrepancy between two versions of capitalism.

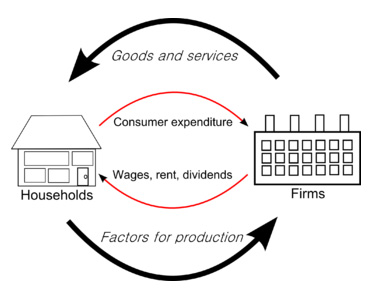

Scott Stephens rightly identifies as “dishonest money” the modern economic phenomenon of monetary expansion. The 2008 crisis not only exposed its faulty foundation, but according to Stephen should also lead to self-examination as to our participation in this crisis due to greed and extravagant lifestyle. Furthermore, it ought to direct us to a realization working for common good and the need for alternative community with a different economic system. He looks to the Church to provide such a community with an economic system different from capitalism.

This is the point that disturbs me, his association of “dishonest money” with capitalism. He appeals to history as his basis. He identifies that monetary expansion has been in existence since 4th century B. C. Aristotle was actually “shocked to observe that the efficiency and simplicity of the market seemed to unleash something monstrous in the human heart.” He further narrates that as people perceived the potential of monetary expansion, they started to lust after unlimited profit. This seemingly unlimited increase in the quantity of money carried with it destructive moral vices like greed, dissatisfaction, and loss of self-control. Stephens then mourned that those destructive vices in time have been turned into “celebrated virtues” serving as the basic foundation of modern economy. He then concluded, “Capitalism thrives only through these vices.”

As we will see in Reisman’s open letter, it is not actually the free market that unleashed those destructive vices. It was something else. It was the government intervention appearing as “free market.” Stephens’ reading of capitalism is a typical example of misinterpretation of capitalism and an evidence of the success of intervention done by the state.

Stephens’ hope “that those in positions of influence will find a just and effective response to the current credit contraction,” is actually a resignation. Can we really expect that those in power would initiate genuine monetary reform apart from the initiative of an informed public? As Murray Rothbard rightly identifies that due to the combination of both evil and good in human nature, those in power could actually utilize their privilege position for legalized theft.

Stephens’ longing for an alternative community with a different economic system exemplified by the Church could only happen on the basis of a solid understanding of what is really going on. This requires education leading to concrete action. Here I think the Austrian school of economics could provide the necessary tool for us to re-examine the real nature and character of free market economy.